Auto enrolment is here to stay – The Pension Regulator reported in 2014 that AE opt-out rates were as low as 10% rather than the predicted 30%. Now more than 9 million UK individuals are contributing regularly to their pension futures.

Auto enrolment is here to stay – The Pension Regulator reported in 2014 that AE opt-out rates were as low as 10% rather than the predicted 30%. Now more than 9 million UK individuals are contributing regularly to their pension futures.

For the moment, we can at least enjoy low minimum contribution levels (employee 1% and employer 1% until Sept 2017) and you could argue that it is because contribution levels are so low that this discourages opt-outs – because ultimately it may not make too much of a dent into an individual’s net pay. Great for everyone, including the spin doctors.

So what next?

You may not be aware that the UK auto enrolment pension is semi based on an Australian model. Interestingly, Australia AE and pension provision is mandatory (employees cannot opt-out) and contributions are much higher. The UK system (at the present) does allow opt-outs, similar to the New Zealand pension system that also influenced UK AE. It will be interesting to see if this very British “Ok, if you’d rather not” attitude will continue especially if we look at where contributions are likely to head?

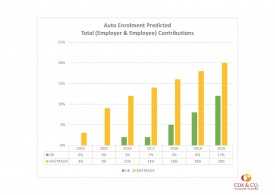

AE Predicted Contributions Graph

Yes, the current UK pension contribution levels at 2% total do fall somewhat behind Australia’s predicted 12%. And perhaps my ‘finger in the air’ predictions for future rises are a little bold. However, Australian experts are pushing for 18% contributions by 2020, so bearing this in mind and knowing the UK’s AE pension system has just picked up it’s bike and is pushing on one leg to get going…. it will most likely catch up in the next 10 years. And, as AE comes into it’s own and becomes part of the fabric of an employee’s work life expectation, opt-outs will no doubt become just as taboo as smoking behind the bike sheds.

But as we know societal habits, public opinion and financial mapping are organic creatures. No one can predict the future, especially a financial one that will span many governments to come. Number 10, Downing Street’s euphoria regarding low opt-out AE figures and rhetoric describing a nation taking charge of its retirement provision may well start to wane – especially if they get the sums and application wrong.

For all your auto enrolment needs contact us on 0117 9323444 or email enquiries@payrollsolutionsltd.co.uk

Other’s have been reading:

Auto enrolment payroll process guide